Business Insurance in and around Honolulu

Honolulu! Look no further for small business insurance.

No funny business here

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to consider. You're in good company. State Farm agent Catherine Sing Chow is a business owner, too. Let Catherine Sing Chow help you make sure that your business is properly protected. You won't regret it!

Honolulu! Look no further for small business insurance.

No funny business here

Surprisingly Great Insurance

For your small business, whether it's a HVAC company, an auto parts shop, a barber shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, business liability, and accounts receivable.

Contact the outstanding team at agent Catherine Sing Chow's office to explore the options that may be right for you and your small business.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

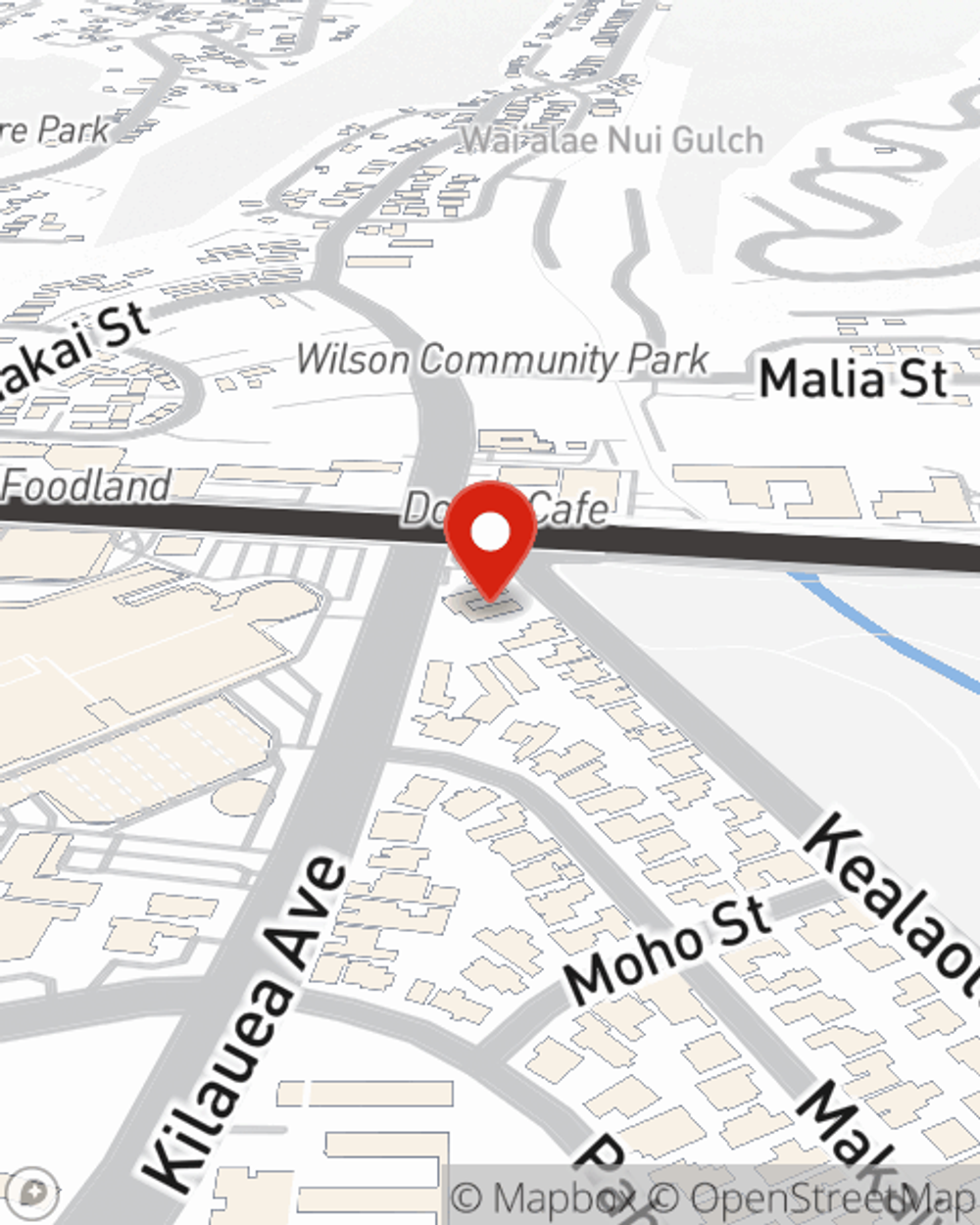

Catherine Sing Chow

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.